Trump May Lose Battle with Powell but Wins the Federal War

SadaNews - The news of the Justice Department launching a criminal investigation into Federal Reserve Chairman Jerome Powell on January 11 has escalated the conflict between U.S. President Donald Trump and the central bank.

So far, it appears that the recent attack on the Federal Reserve has not borne fruit. Nevertheless, the president may ultimately succeed in taking control of the Federal Reserve before leaving office.

At first glance, it seems puzzling that news of this new attack has leaked now, just four months before Powell is set to step down as chairman. The most plausible explanation for the timing of the criminal investigation is that it aims to intimidate Powell and his colleagues at the Federal Reserve.

For Powell, the aim of the intimidation may not be to shorten his presidency as much as to persuade him to resign from the Board of Governors before his term in that role ends on January 31, 2028. Trump’s problem is that Powell is not easily intimidated.

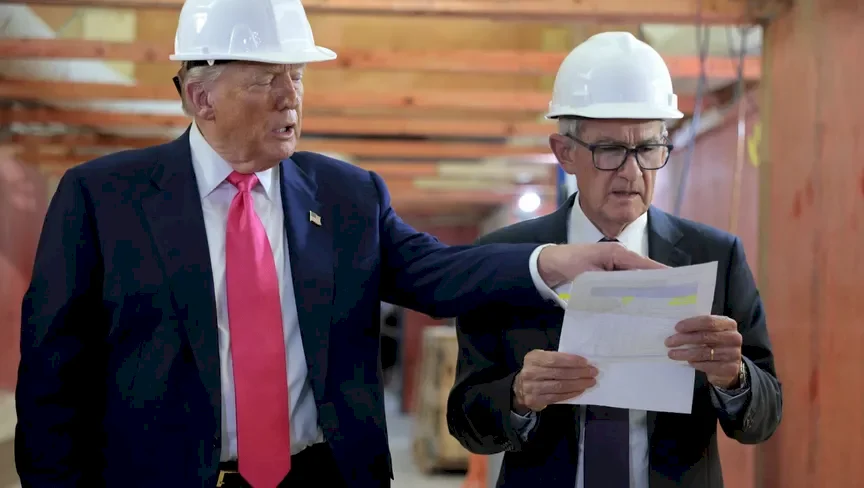

Evidence supporting his calmness: when Trump misstated the cost of renovating the existing buildings during a tour in July, Powell corrected him immediately in front of the television cameras.

As for other policymakers, the aim may be to persuade them either to support the president's campaign to lower interest rates or to resign from their positions. Again, the president may have underestimated the strength of his opponents' positions, as evidenced by the continued presence of Governor Lisa Cook on the board despite Trump's attempts to dismiss her.

In other respects, the recent escalation of the administration against the Federal Reserve seems to play into Trump's favor. It is now difficult to imagine Powell resigning his board seat before the end of his term as governor.

Opposition to Trump's Candidate as a Reaction

Many Republican senators have expressed concern about this latest attempt to subject the Federal Reserve to presidential control. Most importantly, North Carolina Senator Thom Tillis has stated that he will oppose confirming any nominee to the Federal Reserve until this legal matter is resolved. This is critical because Tillis is a member of the Banking Committee, and his vote against would lead to a tie in the committee, effectively halting the nomination process.

In the long term, there is a significant danger that the president could prevail. One of the Federal Reserve governors (Stephen Moore) appears completely committed to Trump’s overarching goals concerning the board, and the second (Michelle Bowman) could be sympathetic to him, in our estimation.

Trump is likely to appoint a third member when Powell leaves the board, at the latest by January 2028. The departure of another member before Trump’s planned exit from office in January 2029 could give the president a working majority on the seven-member board. This majority would have substantial power to restructure the institution and could deeply influence its culture.

The market's reaction to Powell's controversial announcement on January 11 was subdued, and perhaps concerning. In futures markets, the yield on the 10-year Treasury bond did not rise more than 3 basis points from its close on Friday, January 9. Stock price movements were also minor.

The institutional guarantees established by Congress in the Federal Reserve Act of 1935 have withstood unprecedented pressure from Trump and his team. Nevertheless, the president may ultimately gain control over this institution through the most traditional means—the power to appoint Federal Reserve members. If that happens, the institution could undergo radical changes for years to come.

Members of the Federal Reserve Board serve for 14 years. If all current members complete their full terms, Powell will be the only one whose term ends before Trump leaves office. However, no governor has served a full 14-year term at the Federal Reserve since 1990.

Governors often resign after only a few years in office. As shown in the above chart, current officeholders have served comparatively long tenures based on recent historical standards. If Michelle Bowman remains in her position for another 36 months — reaching the end of Trump's term — she will be the longest-serving state governor since at least 1990. Then, both Cook and Philip Jefferson will rank among the governors who have served three-quarters of their terms since 1990.

Short-term Impacts Are Moving in the Wrong Direction

Either the intense attack on the Federal Reserve has failed to change the situation in favor of the administration, or it has pushed it in the opposite direction.

This escalation is likely to persuade Powell to complete his term as governor until January 2028, instead of resigning when he steps down as chairman in May. Staying on the board is a right fully entitled to him — and there are precedents for that — but resignation is the more common step. Nevertheless, these are not ordinary times, and Powell’s loyalty to the institution may be a stronger motivator than adherence to tradition.

We believe that the Federal Open Market Committee will be more cautious about lowering interest rates. When the institution is under political pressure, the committee is likely to increase the burden of proof on those advocating for interest rate cuts, in anticipation of the possibility that the committee could be viewed as surrendering to Trump’s demands.

It may also become somewhat more difficult to confirm Powell’s successor. The number of qualified candidates is expected to shrink. Two of the leading candidates — National Economic Council Director Kevin Hassett and former Federal Reserve Governor Kevin Warsh — may compete to show greater loyalty to Trump.

If either were to gain the president’s approval, they might find it harder to secure confirmation. This could open the door wide for Federal Reserve Governor Christopher Waller or BlackRock CEO Rick Rieder — the other candidates reportedly said to be on the shortlist.

Once in office, the new president may face greater difficulty demonstrating his ability to operate independently of the president. Even beforehand, Trump has been clear about his intention to control monetary policy, stating that he would only nominate someone to succeed Powell who shares his enthusiasm for lowering interest rates. Any new president was expected to have difficulty proving his ability to operate completely independently of presidential control, but recent events will make this harder.

Other board members will face conflicting pressures. On the one hand, they will be urged to remain in their positions after Trump’s term ends, given that it is historically rare for a Federal Reserve governor to serve a full term (14 years). On the other hand, they may face various types of pressures designed to make their careers difficult, extending beyond what they expected.

Loss of a Battle... But Perhaps Winning a War

Traditionally, the essential elements of Federal Reserve governance that enable it to make monetary policy decisions free from presidential political control have included the following:

Protection and necessity of providing justification, ensuring that no president can remove any board member merely on a whim or minor policy disagreement.

Competence of those nominated and appointed to the board.

Engagement of Congress, particularly the Senate, in applying the norms.

So far, the first condition has remained intact, and the oral arguments before the Supreme Court on January 21 will determine whether it continues to hold. The second condition will undergo close scrutiny when President Trump announces his nominee to succeed Powell, and the Senate considers the matter. The third condition has emerged over the past few days, as several Republican senators have expressed varying degrees of concern about the criminal investigation.

Increase in Airfare to Asia and Europe After Gulf Airports Closure

Oil Prices Continue to Rise Amid Heightened Tensions Over the Strait of Hormuz

Gold Rises Amid Fears of Iran War's Impact on US Inflation

Gas Prices in Europe Surge 50% After Qatar Halts Production

Iran's War Dashes Egypt's Hopes for Suez Canal Recovery

Warning of Rising Gasoline Prices in America Due to War on Iran

Qatar Reduces Number of Workers at Largest LNG Export Facility in the World