How Trump's Conflict with the Federal Reserve Threatens Major Central Banks Worldwide?

SadaNews - Global central bank governors who met at a mountain resort in the U.S. in recent days fear they may be engulfed by the political storm surrounding the Federal Reserve (the U.S. central bank).

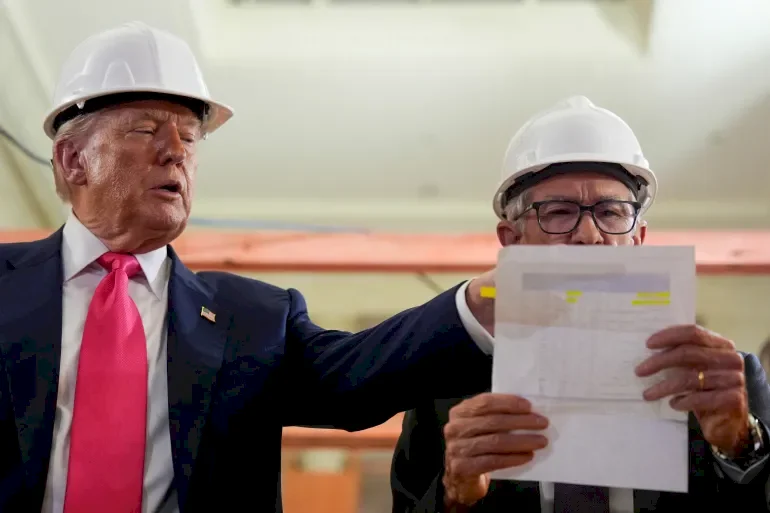

President Donald Trump's efforts to reshape the Federal Reserve according to his vision and pressure it to lower interest rates have raised questions about whether the U.S. central bank can maintain its independence and its ability to combat inflation.

Trump is frustrated with the legal protections granted to the leadership of the Federal Reserve and the long terms of Board of Governors members, designed so they remain in office longer than any president.

Trump is exerting intense pressure on the Chair, Jerome Powell, to resign and is mobilizing efforts to dismiss another board member, Lisa Cook.

If the world's most powerful central bank succumbs to this pressure or Trump finds a way to dismiss its members, it would set a dangerous precedent from Europe to Japan, potentially subjecting established norms of independence in monetary policy to renewed attacks from local politicians.

Olli Rehn, a policymaker at the European Central Bank from Finland, said on the sidelines of the Federal Reserve's annual symposium in Jackson Hole, Wyoming, "Politically motivated attacks on the Fed have spiritual implications for the rest of the world, including Europe."

For this reason, Rehn and his colleagues have enthusiastically supported Powell in maintaining his position even after he signaled the possibility of lowering interest rates in September. Powell received a warm welcome when he took the stage at the conference.

Concerns about Disruptions

Discussions with 12 governors of central banks from around the world on the sidelines of the symposium revealed that any scenario in which the Federal Reserve sees a threat to its ability to combat inflation due to a loss of independence is a direct threat to its stature and to overall economic stability.

They noted that this is likely to lead to significant disruptions in financial markets, with investors demanding a higher premium to hold U.S. bonds and reevaluating the status of U.S. Treasury bonds as the lifeline of the global financial system.

Central banks around the world have already begun preparing for the fallout, instructing the banks they oversee to monitor their exposure to the U.S. dollar.

Most importantly, a capitulation by the Federal Reserve would end a system that has achieved a relative stability in prices and has persisted at least since former Chairman Paul Volcker tamed high inflation 40 years ago.

Since then, other central banks have followed the Federal Reserve's model of political independence and complete focus on its mission, which for most entails keeping inflation close to 2%.

Joachim Nagel, the Governor of the German central bank and a member of the European Central Bank's Governing Council, stated: "This is a reminder that independence should not be taken for granted. We must fulfill our commitments and affirm that independence is a prerequisite for price stability."

A Political Game

Markets have not yet registered deep concerns regarding the Federal Reserve's independence, with U.S. stock markets experiencing a strong rally, and Treasury yields or inflation expectations have not risen to signal a threat to the credibility of the U.S. central bank.

While Trump could appoint a new Chair when Powell's term ends in May, he needs more members of the seven-member board to leave for those he appoints to form a majority.

The Federal Reserve network consists of 12 local reserve banks, and their presidents rotate in voting on interest rate policy, forming another counterbalance as local boards view them as a means to distance themselves from the influence of Washington.

However, Trump's tense relationship with the Federal Reserve, in a country seen as having established institutional and legal traditions, has made other central bank governors acutely aware of the fragility of their institutions' independence.

Even the European Central Bank, which EU treaties recognize as independent from the governments of the 20 Eurozone countries, has had to work diligently to prove this.

Right-wing and left-wing parties in countries such as Italy, Germany, and France have periodically criticized the central bank.

Other countries have turned the appointment of central bank governors into a political game.

In Japan, the late Prime Minister Shinzo Abe criticized then-central bank governor Masaaki Shirakawa for not doing enough to combat deflation, and personally chose Haruhiko Kuroda in 2013 to take over after Shirakawa stepped down weeks before his term ended.

Kuroda then launched a massive asset purchase program that helped weaken the yen and revive growth but raised eyebrows among traditional central bank governors for making the Bank of Japan the main debtor to the government.

A Bad Model

Trump has said he is "looking forward" to Powell's term ending next May and has publicly begun the process of choosing his successor.

Reuters quoted a source described as familiar with the Bank of Japan's approach, who asked not to be named due to the sensitivity of the issue: "It seems as if Trump has learned from Abe."

In contrast, Trump's actions might encourage governments around the world, especially those with populist leanings, to assert control over central banks.

This could pave the way for rising inflation rates globally and increased market volatility.

Maurice Obstfeld, a senior fellow at the Peterson Institute for International Economics and former chief economist at the IMF, said: "Control over the Federal Reserve is a development that could set a very bad example for other governments."

He added: "How do you look at what is happening in the United States, which was thought to be a bastion of institutional checks and balances and the rule of law, and not conclude that other countries are easier targets?"

Source: Reuters

Oil Prices Drop as Market Shifts Focus to Supply Surplus Forecasts

Gold Holds at $5,000 an Ounce for the Second Day

The Dollar Takes Repeated Hits and Potential Intervention May Lower Its Value

Oil Stabilizes Amid Return of Kazakhstan Exports and Rising Risks from Iran

The price of an ounce surpasses the $5000 mark as geopolitical concerns rise and silver ap...

What does a billionaire from Hong Kong say about investing a quarter of his wealth in gold...

Despite Trump’s Pressure.. "The Federal Reserve" Leads Its Global Peers to Keep Interest R...