Norwegian Sovereign Wealth Fund Reduces Its Stakes in Major American Technology Companies

SadaNews - The Norwegian sovereign wealth fund, valued at $2.2 trillion, has reduced its stakes in the largest American technology companies, including its largest investment in Nvidia, during the second half of 2025, according to a recent investment list published.

By the end of the year, the "Norwegian Investment Bank" managing the fund had reduced its stakes in the four largest tech companies in its portfolio, which also includes Apple, Microsoft, and Alphabet.

The fund also lowered its stake in semiconductor giant Nvidia to 1.26% from 1.32% by the end of June, and cut its ownership in Microsoft to 1.26% from 1.35%.

Despite this, both companies remain among the top five investments by value in the fund's portfolio, followed by Alphabet and Amazon.com, while Apple ranks second among the largest investments.

Widespread Restructuring of the Portfolio Globally

The fund owns about 1.5% of all publicly listed companies globally and has reduced its investments in more than 1,000 companies over the last six months of 2025, bringing the total number of companies in its portfolio to 7,201 spread across 60 countries, as part of a strategy to simplify the investment portfolio.

The fund exited the stock markets in Moldova, Iceland, Croatia, and Estonia, while adding Jordan and Panama to its list of countries for investment.

The fund's largest bond holdings come from U.S. Treasury bonds, followed by Japanese government bonds, and then German bonds. Across all asset classes, the fund directs about 53% of its investments to the United States.

Warnings About Geopolitical Risks

An advisory committee appointed by the government earlier this week warned that the wealth fund needs to enhance its readiness to handle the escalating geopolitical risks. It pointed to the increasing use of tools such as tariffs, financial sanctions, and trade restrictions to achieve geopolitical objectives.

The fund also faced backlash from several Republican lawmakers in the United States last year after selling its entire stake in Caterpillar.

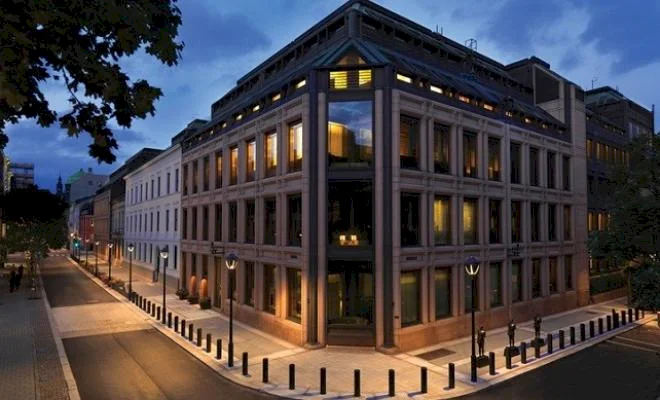

"Norwegian Investment Bank" was established in the early 1990s and invests based on a benchmark determined by the Norwegian Ministry of Finance, which limits its ability to make wide-ranging active investment moves. Its portfolio spans stocks, fixed income, real estate, and renewable energy infrastructure, all outside Norway.

Norwegian Sovereign Wealth Fund Reduces Its Stakes in Major American Technology Companies

Gold Surpasses $5,500 and Silver Records New All-Time High

The U.S. Federal Reserve Holds Interest Rates Steady in Its First Meeting of 2026

Artificial Intelligence Causes Amazon to Lay Off 16,000 Employees

Generation "Z" Leads Economic Transformation in the Arab World

Trump's Threats to Iran Bring Oil Close to Four-Month High

Gold ounce exceeds $5200.. Silver records near $114 an ounce