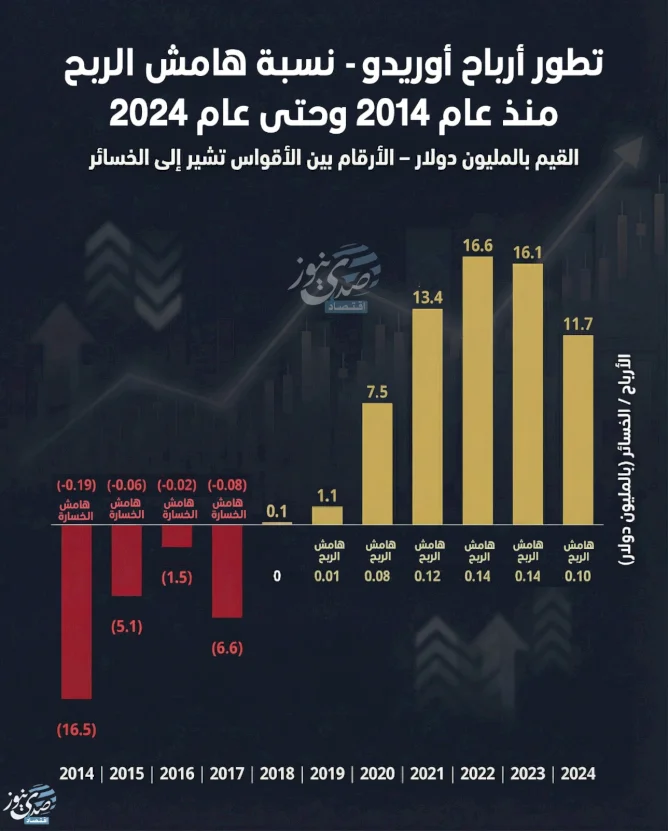

The Evolution of Ooredoo's Profits - Profit Margin Percentage from 2014 to 2024

SadaNews - Ooredoo, the Palestine National Mobile Telecommunications Company, saw its stock rise by more than 54% since the beginning of the current year 2026, closing at $1.39 at the end of the session on 22/1/2026, compared to $0.90 in the session on 31/12/2025.

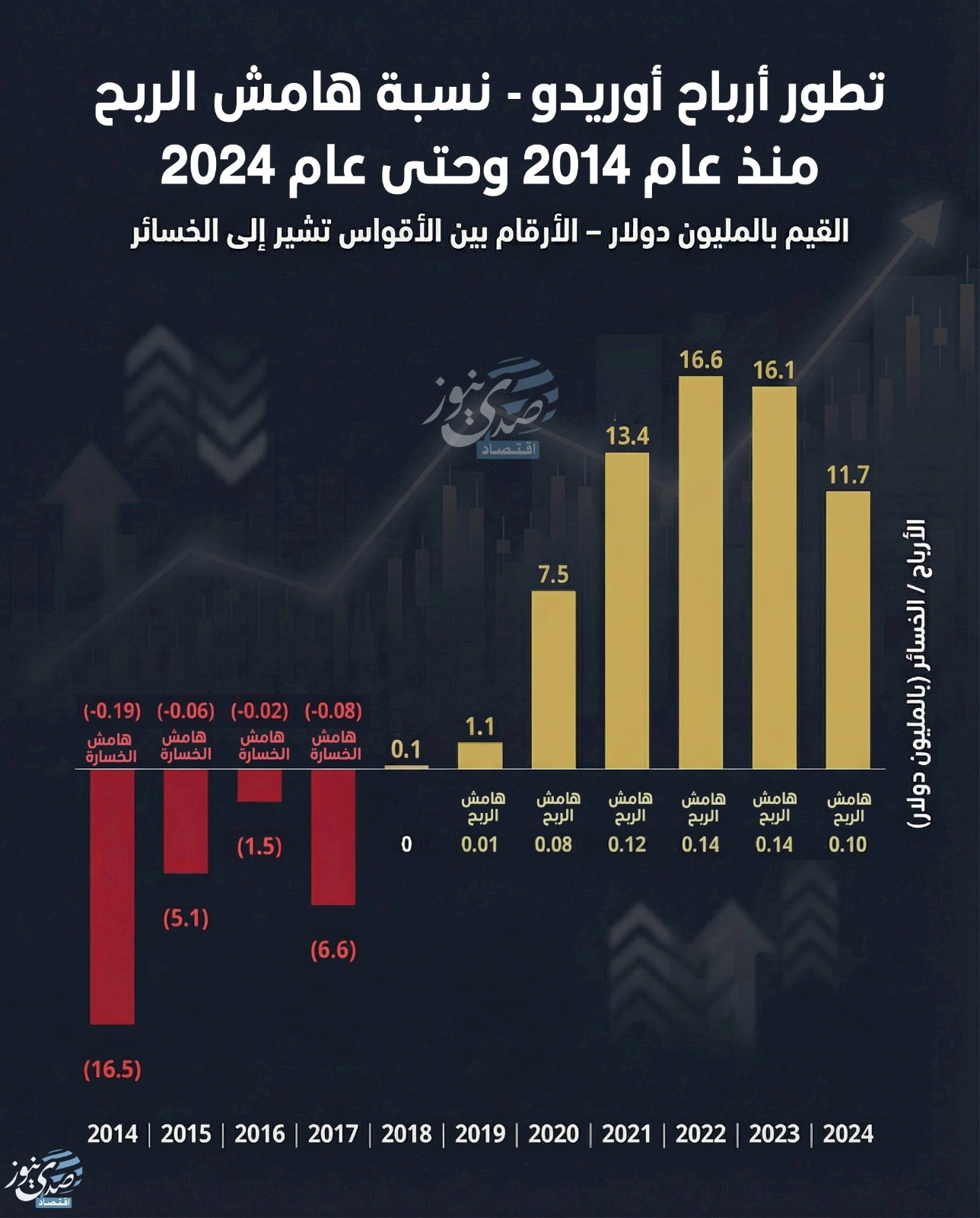

This increase is attributed to the positive results achieved over the past few years, which have witnessed significant growth in financial indicators, especially profitability, as the company transitioned from a loss situation to a break-even point, and then to profitability and sustainable growth in earnings.

The following infographic illustrates the profits for the period and the profit margin percentage from 2014 to 2024.

Growth is considered one of the most important drivers of the company's market value increase, as Ooredoo's subscriber base has shown continuous growth since 2014, fueled by its entry into the Gaza Strip market in 2017, reaching 1.4 million subscribers by the end of 2021. By the end of 2024, the number of subscribers reached 1.55 million compared to 1.43 million in 2023.

Recently, a settlement was reached between Ooredoo and the Palestinian government valued at $120 million in January 2026, which includes cash payments and contributions to rebuild networks. The company is also collaborating with the Monetary Authority to enhance electronic payment solutions and digital transformation, in addition to agreements with the Ministry of Interior for interlinking.

As the company heads towards restructuring its capital, writing off all accumulated losses, and achieving sustainable growth in profits with improvements in all financial indicators, the company will have the ability to distribute dividends to shareholders for the first time since its listing in 2011.

Over the past years, the company has managed to reduce the accumulated losses resulting from the establishment period. If the capital is restructured by reducing it by the amount of accumulated losses, the company will trade at an attractive price-to-earnings ratio of 9-10 times, and the fair value of the share will rise to between $1.5-2, enabling the company to provide sustainable dividends between 6-10%.

The Evolution of Ooredoo's Profits - Profit Margin Percentage from 2014 to 2024

Palestine: Construction Costs for Residential Buildings in the West Bank - 2025

More than 16,000 Traders Enter the Palestinian Market in the Last 5 Years

The Licensed Forex Market in Palestine - Indicators of 2025

Comparison of Wholesale Prices in Palestine Between 2024 and 2025

Wholesale Price Jumps in Palestine: 5 Years of Sharp Fluctuations

Stocks Traded on the Palestine Stock Exchange: Rise in 2022, Decline in 2024, and Partial...