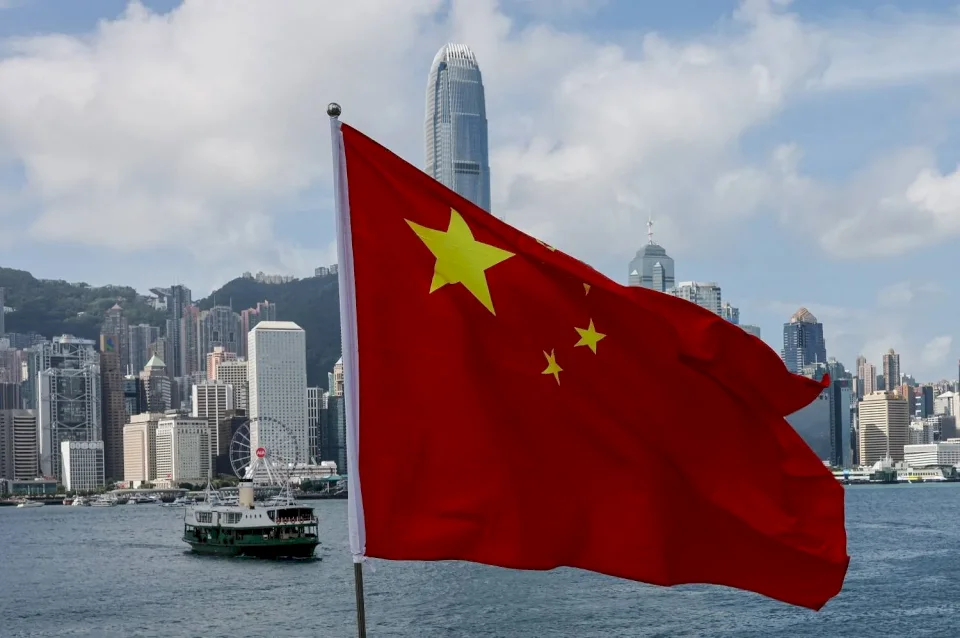

China Begins Promoting Sovereign Bonds to Raise Approximately 4 Billion Euros

SadaNews - China has started promoting euro-denominated sovereign bonds to raise up to 4 billion euros ($4.6 billion), according to a person familiar with the matter, just days after a strong demand for dollar-denominated bonds was introduced.

The Ministry of Finance is looking to price the four-year tranche of the dual offering at about 28 basis points above the average swap rate, according to the individual who requested anonymity to discuss private matters. The so-called initial price guidance for the seven-year tranche is about 38 basis points.

Improvement in Investor Sentiment Amid Easing Trade Tensions

The euro issuance follows China's successful sale of $4 billion in dollar-denominated bonds about two weeks ago, during a time when easing trade tensions with the United States enhanced investor sentiment towards the country.

Said Li Zhu, Head of Asian Fixed Income at "Fidelity": "Global investors are keen to buy Chinese sovereign bonds as part of a larger diversification strategy."

He added that "euro-denominated assets are witnessing strong demand due to the strong currency gains, tightening credit spreads, and attractive yields."

Increasing Role in the Euro Market

The annual fundraising process in global debt markets is part of Beijing's goal to build deeper sovereign yield curves that can serve as benchmarks for Chinese companies pricing their own bonds. This is particularly significant in the euro market, where liquidity remains relatively weak for Chinese borrowers.

The latest Chinese dollar bond offering attracted orders nearly 30 times the size of the deal.

The strong demand helped the country price the bonds nearly in line with U.S. Treasuries, despite the fact that the United States enjoys a much stronger credit rating and a far larger role in the global financial system.

The Trap of High Prices: Debts Haunt Germans and Bankruptcy Knocks at Their Doors

Major Changes in the Saudi Public Investment Fund… What is Happening?

Gold Stabilizes and Heads for its Seventh Consecutive Monthly Gain

The IMF Disburses Approximately $2.3 Billion to Egypt Following Two Reviews of the "Reform...

Oil Rises Amid Expectations for Nuclear Negotiations Between Washington and Tehran

Gold prices near $5187 per ounce as tensions escalate

How Will Oil Be Affected If Tensions Between Washington and Tehran Escalate?