Oil Prices Surge Amid Ukrainian Strikes and U.S. Sanctions on Russia

SadaNews - Oil prices surged sharply as traders assessed the escalating risks threatening Russian supplies due to Ukrainian military strikes and U.S. sanctions, limiting the impact of increasing indicators pointing to an impending painful surplus in the global oil market.

Brent crude jumped above $64 a barrel, rising as much as 3% in a swift move before trimming some of its gains, while West Texas Intermediate crude approached $60.

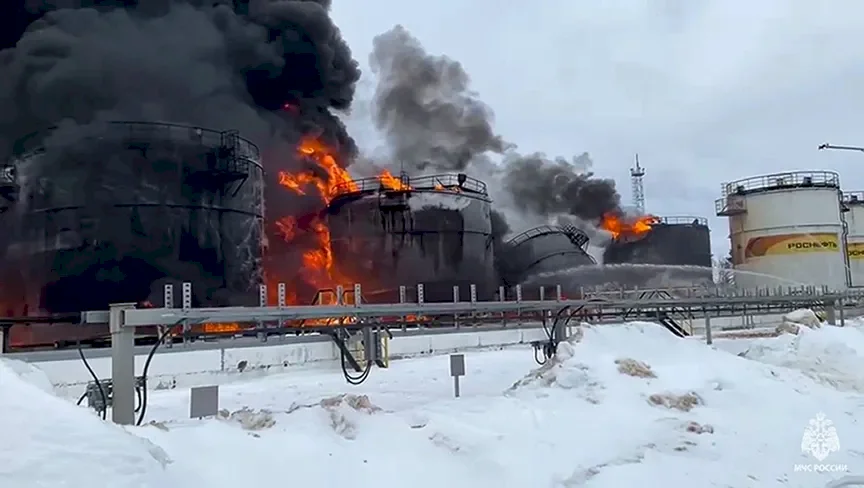

Local authorities reported that a widespread drone attack struck an oil depot and a ship at the port of Novorossiysk. Novorossiysk is one of the key ports on the Black Sea, handling Russian shipments and Kazakh exports.

“Significant Risk” to Russian Oil

In addition to the military developments, Washington recently imposed sanctions on the companies “Rosneft” and “Lukoil” to increase pressure on Moscow due to the war, with the restrictions set to be enforced in the coming days. The International Energy Agency warned Thursday that these steps pose a “significant risk” to its forecasts for Russian production.

However, despite the recent rise, Brent crude is still down about 14% since the beginning of the year, affected by growing expectations regarding a substantial oversupply. OPEC countries and their allies have resumed halted production capacity to regain market shares, and nations outside the alliance have also increased their output.

John Driscoll, founder and director of JTD Energy Services, stated that "what we are witnessing is a familiar pattern, consisting of repeated temporary spikes followed by sharp corrections." He added that the risks of Ukrainian attacks on Russian facilities, the sanctions, geopolitical uncertainty, combined with oil demand at the end of the year, are all currently factors intertwining to limit the correction wave.

Russian Refineries Under Fire

Traders continue to assess the cumulative impact of Ukrainian strikes targeting Russia's energy infrastructure, which have taken the form of a series of long-range attacks on ports and refineries in an attempt to reduce oil revenue that funds Moscow's war.

Venezuela, a member of OPEC, has also been in the spotlight after the approach of a U.S. aircraft carrier raised tensions in the country.

Potential U.S. Strike on Venezuela

The CBS network reported that military officials presented U.S. President Donald Trump with options for potential operations in Venezuela in the coming days.

In this context, the International Energy Agency raised its surplus estimates again on Thursday as OPEC+ continues to increase supplies and demand growth remains weak. The previous day, the group of producers stated that global oil production exceeded demand in the third quarter after previously expecting a deficit.

Among other negative signals this week was a significant rise in U.S. crude inventories to the highest level since June. The price gap between West Texas Intermediate futures contracts of different maturities also shrank to range, entering a state of "contango" at one point, where the nearest-term contract is traded at a discount compared to the subsequent contract, a sign of the abundance of immediate oil supplies.

The Trap of High Prices: Debts Haunt Germans and Bankruptcy Knocks at Their Doors

Major Changes in the Saudi Public Investment Fund… What is Happening?

Gold Stabilizes and Heads for its Seventh Consecutive Monthly Gain

The IMF Disburses Approximately $2.3 Billion to Egypt Following Two Reviews of the "Reform...

Oil Rises Amid Expectations for Nuclear Negotiations Between Washington and Tehran

Gold prices near $5187 per ounce as tensions escalate

How Will Oil Be Affected If Tensions Between Washington and Tehran Escalate?