"For Moral Reasons".. The Norwegian Fund Withdraws Investments from American Company "Caterpillar"

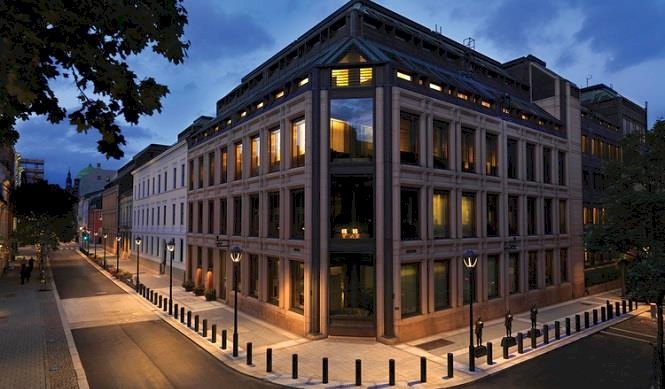

SadaNews - The Norwegian sovereign wealth fund, the largest in the world with assets exceeding two trillion dollars, has announced its decision to withdraw investments from the American construction equipment company Caterpillar, along with five Israeli banking groups, due to moral reasons related to human rights violations in the occupied Palestinian territories.

The fund, managed by the Norwegian central bank, specified that the excluded banks are: Bank Hapoalim, Leumi Bank, Mizrahi Tefahot Bank, First International Bank of Israel, and FIBI Holdings, pointing out the presence of "unacceptable risks" from these institutions contributing to serious violations during the war and conflict.

According to the fund's records, its stake in Caterpillar was approximately 2.1 billion dollars (1.17%) as of June 30, while its investments in the five Israeli banks combined amounted to 661 million dollars.

The fund's ethics council confirmed that Caterpillar's products, particularly bulldozers, have been used by the Israeli authorities for widespread demolition of Palestinian property in Gaza and the West Bank, stating that the company had taken no action to prevent this use. It also pointed out that resuming the delivery of these machines to Israel increases the risk of the company's contribution to serious violations of international humanitarian law.

As for the Israeli banks, the council concluded that they played a critical role in financing and facilitating settlement activities in the West Bank and East Jerusalem by providing necessary financial services for the construction and expansion of settlements.

The Norwegian fund invests in approximately 8,400 companies worldwide and is subject to strict ethical requirements set by the Norwegian Parliament, while the ethics council has the authority to make recommendations to the board of the central bank, which decides on investments.

It is worth mentioning that the fund announced last August its intention to withdraw from six Israeli companies in light of the war in Gaza and developments in the West Bank, without revealing their names at that time.

The Trap of High Prices: Debts Haunt Germans and Bankruptcy Knocks at Their Doors

Major Changes in the Saudi Public Investment Fund… What is Happening?

Gold Stabilizes and Heads for its Seventh Consecutive Monthly Gain

The IMF Disburses Approximately $2.3 Billion to Egypt Following Two Reviews of the "Reform...

Oil Rises Amid Expectations for Nuclear Negotiations Between Washington and Tehran

Gold prices near $5187 per ounce as tensions escalate

How Will Oil Be Affected If Tensions Between Washington and Tehran Escalate?