Trump Presses Again on the Federal Reserve After Producer Price Data

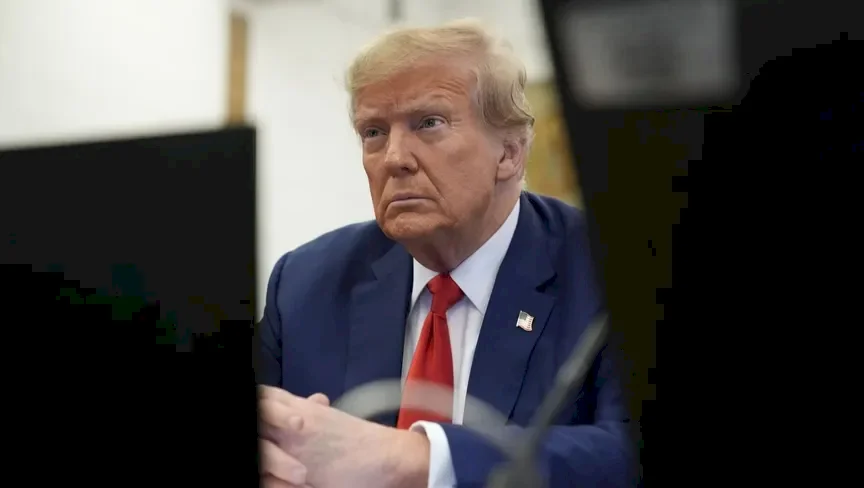

SadaNews - U.S. President Donald Trump renewed his attack on Federal Reserve Chairman Jerome Powell just minutes after the release of data from the U.S. Producer Price Index, demanding a "significant and immediate" cut in interest rates.

After data indicated that the U.S. Producer Price Index experienced its first decline in four months, Trump posted on social media, "The data shows there is no inflation in America!! The far-too-late (i.e., Powell) must cut rates immediately and significantly." He referred to the Federal Reserve Chairman as a "true disaster."

Decline in Wholesale Price Inflation in the United States

Wholesale price inflation in the United States unexpectedly declined in August for the first time in four months. The Producer Price Index fell by 0.1% compared to the previous month, and July's data was revised downward, according to a report from the Bureau of Labor Statistics released on Wednesday.

The drop in wholesale price inflation in August could indicate an anticipated improvement in U.S. consumer price data for the current month, supporting the scenario for interest rate cuts. This comes a day after it was revealed that U.S. labor market data had been revised downward, with job growth in the United States being much lower for the year ending in March than previous estimates suggested, indicating that the labor market was weaker than initial estimates.

U.S. Labor Market Data Revised Down by 911,000 Jobs

It is widely expected that monetary policy makers will cut interest rates at their upcoming meeting next week in an effort to combat the rapid slowdown in the labor market. Federal Reserve Chairman Jerome Powell had cautiously opened the door to interest rate cuts during the "Jackson Hole" seminar organized by the Federal Reserve last month.

During the "Jackson Hole" seminar, Powell indicated in his speech that the U.S. central bank is likely to move to cut interest rates in September, after keeping the benchmark interest rate unchanged throughout the first eight months of the year. He pointed to a "shift in the balance of risks" that may warrant a monetary policy adjustment."

Losses Devour a Third of Silver's Value While Gold Experiences Its Biggest Decline Since t...

Trump threatens to impose tariffs on any country selling oil to Cuba, will reveal his nomi...

After rejecting Maliki.. What are Trump's economic cards to pressure Iraq?

Jordanian Central Bank Decides to Maintain Interest Rate

Oil Continues to Rise Amid Increasing US Threats to Iran

Norwegian Sovereign Wealth Fund Reduces Its Stakes in Major American Technology Companies

Gold Surpasses $5,500 and Silver Records New All-Time High